1. It is no surprise that ideological or political leanings can cloud our judgement about various apparently objective issues like the state of the economy. Accordingly staunch supporters of a party are less likely to acknowledge bad economic or other news when their party is in power. Times points to recent studies which show that it may be possible to overcome this partisan bias if we pay people responding to these questions,

When survey respondents were offered a small cash reward — a dollar or two — for producing a correct answer about the unemployment rate and other economic conditions, they were more likely to be accurate and less likely to produce an answer that fit their partisan biases. In other words, when money was added to the equation, questions about the economy became less like asking people which football team they thought was best, and more like asking them to place a wager. Even a little bit of cash gets people to think harder about the situation and answer more objectively...

The effect was even more pronounced when respondents were rewarded for honestly answering “I don’t know” when they didn’t have enough information. Otherwise, it appears that people will respond objectively to questions when they know the answer, but revert to their partisan biases when they don’t. The paper by Mr. John G Bullock, Alan S. Gerber, Seth J. Hill and Gregory A. Huber found that offering a $1 payment for a correct response and a 33-cent payment for an answer of “Don’t know” eliminated the entire partisan gap between Democrats and Republicans on questions about the economy.

Interestingly, in the paper by Mr. Prior, Gaurav Sood and Kabir Khanna, the cash payments became less effective at coaxing an accurate answer if the question mentioned the president by name. George W. Bush was president at the time of the survey, but by extension it appears that Americans can be more objective answering a question like “Is the unemployment rate lower or higher than it was seven years ago?” than a question like “Is the unemployment rate lower or higher than it was when Barack Obama became president?” even though as a factual matter those are the same question.

Among other things, these findings highlight the critical importance of framing and decision architecture while making surveys. Given that most surveys miss such nuances, it may be a good reason to take their findings with a pinch of salt.

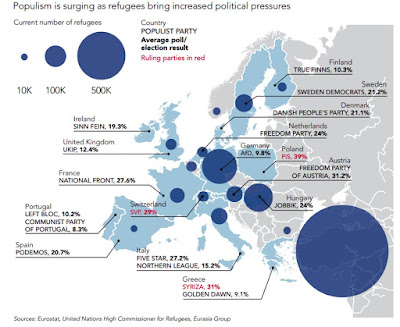

2. The Eurasia group has this striking map of the growing influence of anti-immigrant nationalist parties in Europe on the back of economic weakness and surge in migrants fleeing the civil wars in the Middle East.

This can be a very important politically destabilizing factor in the region.

3. Spicejet, which was close to being grounded by end-December 2014, has engineered a dramatic turn-around, with three consecutive quarters of profits. The Economist has a fascinating description of the Spicejet turnaround, starting with the firms change in management,

He started by negotiating with aircraft-leasing firms for better terms and with lenders for fresh finance, and by injecting equity capital of his own. He cut jobs—and managers’ pay—and scrapped unprofitable routes. Then came a slew of efficiency measures which added up to big improvements in the performance of the carrier’s fleet. Pilots of its Bombardier Q400 turboprops, which serve second-tier cities, were told to step on the gas to shave a few minutes off each flight, making it possible to squeeze in one extra trip each day. The steel brakes on the wheels of its Boeing 737s were replaced with lighter carbon brakes, cutting fuel consumption. The number of in-flight magazines on each aircraft was reduced, and attendants began serving meals in cardboard boxes instead of on plastic trays—again, trimming the aircraft’s weight and cutting fuel burn.

More attention was paid to filling each plane’s tanks with just enough fuel, with a suitable safety margin, but no more. Pilots now lower their planes’ landing gear 7-8km from touchdown, instead of 14km as before; and on the ground they often now taxi on just one engine. Stocks of spare parts were improved at the carrier’s main bases, to get planes back in the air faster. SpiceJet’s aircraft spend roughly 13 hours a day in the air, whereas for other Indian airlines the figure is just 10-12 hours... On the revenue side, the airline has boosted its earnings from ancillary services such as on-board meals and seat selection.

4. Livemint points to the latest CMIE data which show a rise in the value of stalled projectsand declines in both public and private sector capex plans and new project announcements. Both the absolute volumes as well as proportion of stalled projects have been rising.

Interestingly, in contrast to 19.42% of private projects just 4.82% of public projects are stalled. This four-fold differential may point to the far greater difficulty experienced by private sector in managing construction risks with its attendant challenges of site acquisition and permit clearances. One more to the growing list of reasons for adopting the model of public arms-length procurement followed by private contracting.

5. This blog has long held the view that the concern with infrastructure projects is not that projects get delayed, because they get delayed everywhere. FT draws attention to a UK National Audit Office report which says that a third (37) of the large government projects (106) due for delivery over the next five years are unlikely to fully deliver or will remain unfinished due to high staff turnover, skills shortages and poor risk management. The more fundamental concern is the lack of flexibility of restructure those projects and complete them at the earliest, conditional on them getting stuck.

6. FT points to the rapid growth of quasi-sovereign bonds, assumed by state-owned entities, which thought not on the sovereign government's balance sheet has implicit government guarantee and therefore adds to the net sovereign liability. While the stock of EM quasi-sovereign bonds rose from $710 bn in 2014 to $839 bn by end-2015, the total stock of all external EM sovereign debt was just $750 bn at end-2015. Such shape-shifting is bound to further increase concerns about sovereign debt positions among EM economies.

But India has not been one of the major destinations for EM bond inflows. Despite the attractively priced low interest rates, reflecting their weak investment intentions, Indian corporates raised just $35.7 bn through domestic and off-shore debt markets in 2015, a drop of 28% over 2014 and the lowest in six years. Of this, just $8.9 bn was raised off-shore through 34 deals, compared with $18.8 bn and $35 bn over the previous two years.

7. Spurred on by the cheap credit and corporate cash hordes (still $1.8 trillion with S&P 500 companies in the US) with limited investment opportunities, M&A deal-making scaled its highest ever volume at $4.59 trillion eclipsing the earlier record of $4.13 trillion in 2007, including 137 mega deals involving more than $5 bn.

In times of economic weakness, businesses see M&A as a susbstitute to organic growth. In sectors like pharmaceuticals, businesses have come to see M&A as a means to avoid the costs and uncertainties associated with conventional drugs discovery process. The FT writes that unlike 2007

... there is greater availability of cheap financing and the healthier state of corporate balance sheets. In 2007, the benchmark US 10-year Treasury yield sat at 4.6 per cent compared with 2.2 per cent today. And even after record levels of share repurchases in this cycle, companies in the S&P 500 index are still holding more than $1.8tn of cash, compared with $0.8tn back then. Both facts suggest there is ample firepower for companies to pursue transactions. Companies are also increasingly using their own equity to pay for deals. This year, 47 per cent of all takeover activity has been at least in part financed with stock, compared with 21 per cent in 2007.

8. Even as India's makes a massive manufacturing push, its exports have tanked big time, declining continuously for twelve months.

9. Livemint has another graphic that points to the skewed nature of bank credit allocation across sectors - housing makes up more than a third of total incremental credit, seven times industrial credit; personal consumption loans made up 58.4% of total incremental credit.

Note the small volumes - less than $2 bn of bank loans to manufacturing!

10. Finally, this puts in perspective the scale of decline in commodities prices,

As a result of reduced Chinese demand, 42 of the 46 commodities that the World Bank tracks traded at their lowest level since the early 1980s in 2015.